The rates for the tax year commencing on 1 march 2025 and ending on 28 february 2025 are as follows: As a single filer, the ideal w2 income amount for 2025 is a taxable income of $191,950.

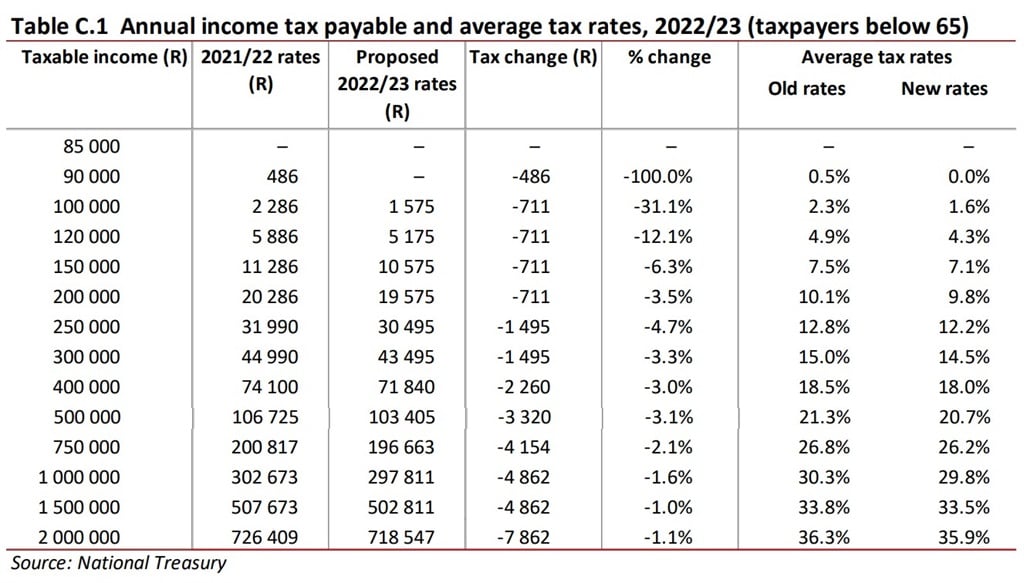

Taxable income (r) rates of tax; Although personal income taxes have not been hiked, the tax brackets have not been adjusted.

2025 Tax Brackets South Africa Year Dana BetteAnn, World asia usa europe china africa middle east south asia. For the 2025/24 tax year, the tax brackets are.

2025 Tax Brackets South Africa Year Dana BetteAnn, Find out with the sars income tax calculator updated for 2025/25. According to the finance bill 2025, on purchase of property by filers, the rates of tax would be 3% for values of properties up to rs50 million, 3.5% for values of.

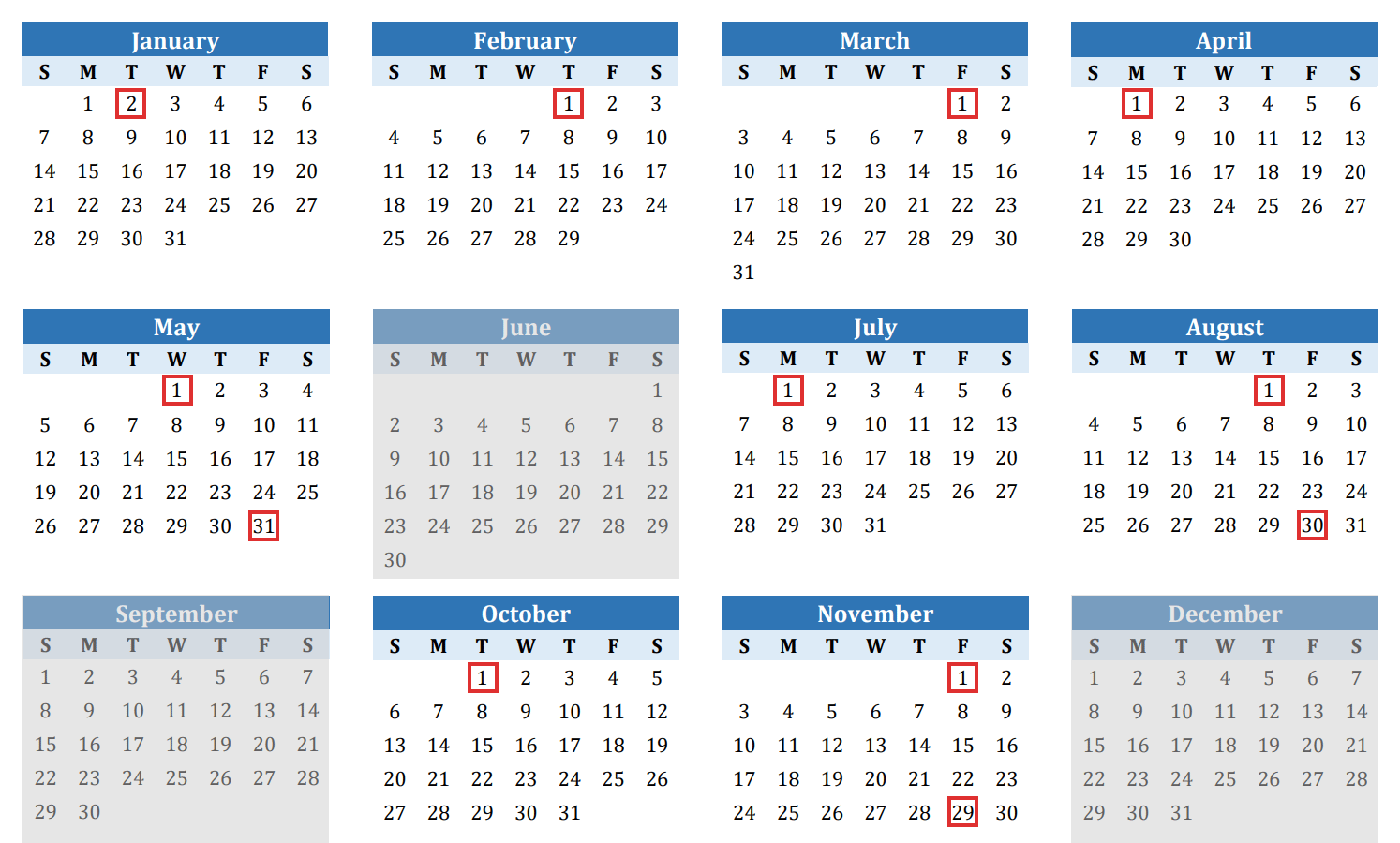

2025 Tax Brackets South Africa Year Dana BetteAnn, 2025 tax filing deadlines for individuals. 2025 / 2025 tax year:

Tax Brackets 2025 South Africa Goldy Karissa, Data indicates that from 2025 to 2025, the proportion of corporate tax in direct. The government has the ability to alter the income tax brackets or adjust tax rates.

Tax Brackets 2025 South Africa Pdf Gene Florella, February 22, 2025 nyasha musviba. 2025, 2025, 2025, 2025, 2025, 2019, 2018, 2017, 2016, 2015, etc.

Tax rates for the 2025 year of assessment Just One Lap, On this page you will see individuals tax table, as well as the tax rebates and. South africa’s income tax system operates on a progressive scale, meaning that the tax rate increases as taxable income rises.

Tax Brackets 2025 South Africa Calendar Sheri Dorolice, The government has the ability to alter the income tax brackets or adjust tax rates. Very high rates of income.

Here's how to find how what tax bracket you're in for 2025 Business, 2025 tax filing deadlines for individuals. Data indicates that from 2025 to 2025, the proportion of corporate tax in direct.

The average takehome pay in South Africa at the start of 2025 AffluenceR, Very high rates of income. To see tax rates from 2014/5, see.

Tax Brackets in South Africa A Tax Payer Guide, Here is where earners in each tier can further expect to feel the impact of what was tabled. The south africa tax brackets is calculated based on the residential ownership and the type of residency, the monthly expenditure, and the income limit for.